The clues we provide were pulled from the corporation’s 2024 proxy statement:

Clue #1: “Full-year 2023 revenues were $58.5 billion, reflecting a 41% operational decline, primarily due to the expected decline in revenues related to COVID-19 products. Despite the challenges, a number of significant achievements created a strong foundation for the year end and fortified our potential long-term growth.”

Clue #2: “In December 2023, we acquired Seagan, one of the largest investments in [our] history, and a critical step toward our goal to achieve world class oncology leadership. We are now poised to accelerate the next generation of potential breakthrough treatments and bring new hope to people living with cancer everywhere. Our industry leading oncology portfolio now includes over 25 approved medicines and biosimulars across more than 40 indications…”

Emcee’s commentary: Hope is a powerful marketing tool that is often misused.

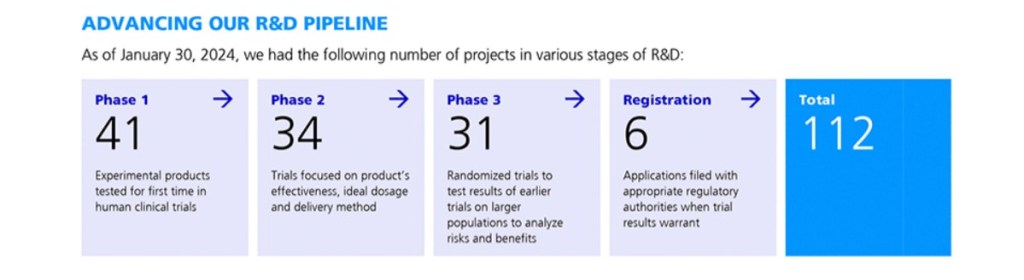

Clue #3: As of January 30, 2024, the corporation had the following number of projects in its R&D pipeline.

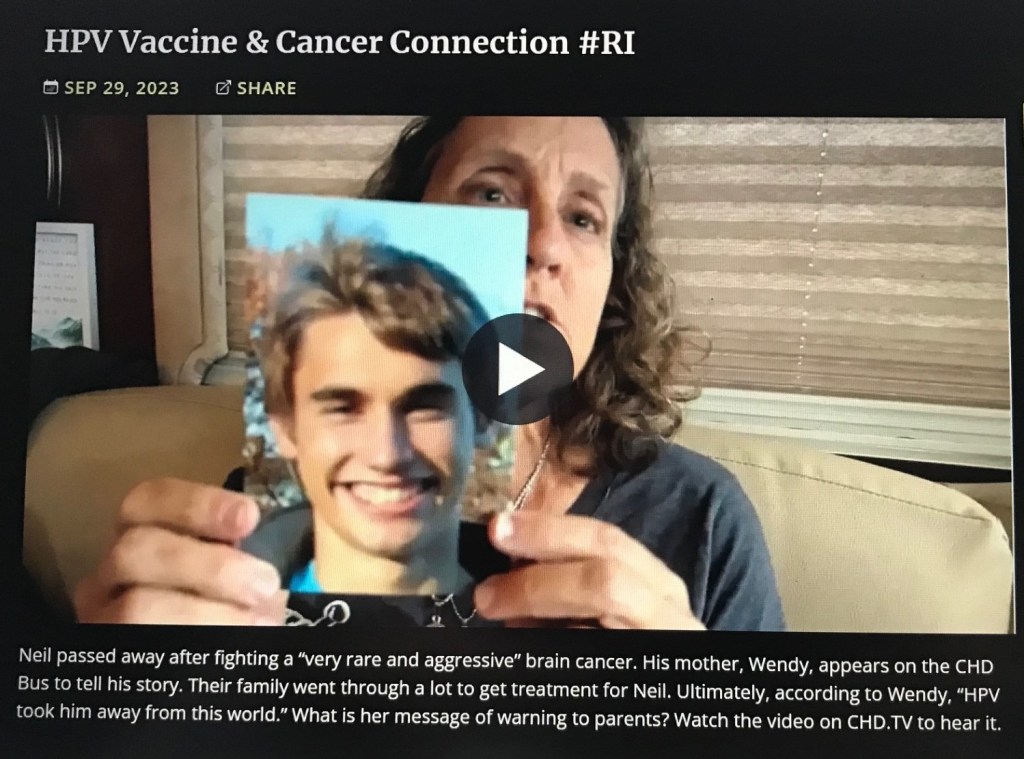

Emcee’s commentary: Failed COVID-19 products, approved for Emergency Use Authorization and marketed as being “safe and effective,” are being linked to higher incidence of aggressive cancers, as well as debilitating neurologic and cardiovascular diseases?

Clue #4: “Stock ownership guidelines promote the alignment of interests with shareholders by requiring the CEO to own [corporation] stock with a value equal to or at least eight times his base salary…” The Chairman/CEO’s 2023 base salary was $1,787,500, and his total 2023 compensation was $21,562,064. The CEO’s target total direct compensation for 2023 was 92 percent performance-based.

Emcee’s commentary: The Chairman/CEO earned a total 2022 compensation of $33,017,453. His total compensation dropped from $33 million to $22 million. Poor guy!

Clue #5: The stock’s price dropped from $59.05 on 12/30/21 to $28.79 on 12/28/23.

Can you name that corporation?

Here’s one last hint…

A new blockbuster book, baring the name of this corporation (The ____ Papers), reveals how it deceived the public by suppressing horrifying clinical trial results from human testing of its COVID-19 product. The decline in revenues was inevitable.

Emcee’s commentary: 40 years ago, I worked in the Corporate Communications Department of MFS, a company that manages mutual funds and institutional investment portfolios. One of my responsibilities was to proofread shareholder marketing materials – sales brochures, annual and quarterly reports, prospectuses and proxy statements. I had to read them multiple times, before they went to print. Hundreds of pages of tedium! Today I can finally appreciate the value of these documents. It’s like reading a storybook – The Book of Proxy. Hmmm, sounds almost biblical. There must be a lesson here.

The word proxy has multiple meanings:

- the authority to act for another

- a document empowering a person to act for another, as in voting

- an election

Every corporation is required by law to issue a proxy statement on an annual basis. The statement is distributed to the shareholders and made publicly available online. It summarizes operational performance and recommends board membership and executive compensation. The proxy statement also urges shareholders to vote FOR the slate of board members and FOR the executive compensation plan.

Finally, at the end of the proxy statement, there is a presentation of shareholder proposals and the board generally recommends voting AGAINST these, because such proposals are not in the best interest of the company’s stock value. (A few shareholders may raise ethical issues that could complicate corporate operations.)

Investors place their life savings and their retirement assets in mutual funds and institutionally-managed 401Ks, pension plans and family trusts, because they want to share in stock value growth, profits and dividends. When directors make bad decisions, shareholders will eventually pay the price.

Marketing packaged as “hope” is often a manipulation of people’s fear. There is a reason many marketing pieces focus on buyers’ pain points. Keep this in mind. Also, keep one eye on your wealth, and keep the other eye on your health.

We published new book, DIPG: Eternal Hope Versus Terminal Corruption. Please check out our DIPG Book web page. Open your eyes. Real Eyes Realize Real Lies. We must take a closer look at Big Pharma marketing, the mainstream medical system and the government agencies who approve their products and protocols for use on children, teens and adults. Follow us on “X” @dipgbook.